The Definitive Guide for Chapter 13 Bankruptcy Lawyer Tulsa

The Definitive Guide for Chapter 13 Bankruptcy Lawyer Tulsa

Blog Article

Little Known Facts About Chapter 7 Vs Chapter 13 Bankruptcy.

Table of ContentsTop Guidelines Of Best Bankruptcy Attorney TulsaTulsa Ok Bankruptcy Attorney Things To Know Before You BuyExcitement About Tulsa Ok Bankruptcy AttorneyThe Only Guide for Top Tulsa Bankruptcy LawyersBest Bankruptcy Attorney Tulsa for DummiesHow Tulsa Bankruptcy Filing Assistance can Save You Time, Stress, and Money.

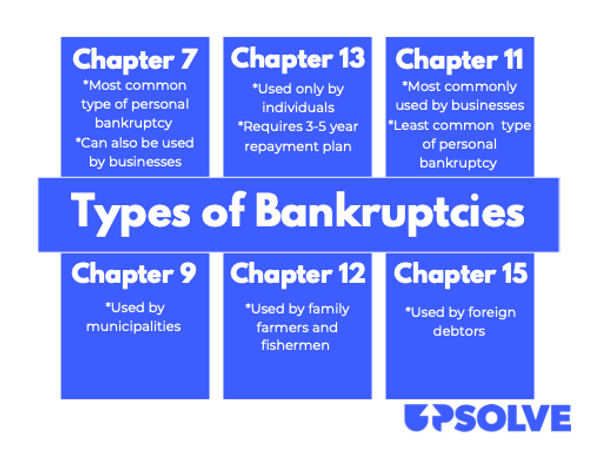

People should make use of Phase 11 when their financial debts go beyond Phase 13 debt restrictions. It rarely makes good sense in other instances but has extra choices for lien stripping and cramdowns on unsafe parts of guaranteed lendings. Chapter 12 insolvency is made for farmers and anglers. Chapter 12 settlement plans can be extra versatile in Phase 13.The methods examination checks out your average regular monthly income for the six months preceding your filing date and contrasts it against the median earnings for a comparable house in your state. If your earnings is listed below the state average, you immediately pass and do not need to complete the whole kind.

If you are married, you can file for bankruptcy jointly with your partner or independently.

Declaring insolvency can help a person by throwing out financial debt or making a strategy to pay off debts. An insolvency case usually begins when the debtor submits a request with the personal bankruptcy court. There are different types of insolvencies, which are normally referred to by their phase in the U.S. Insolvency Code.

If you are facing economic challenges in your individual life or in your business, opportunities are the principle of declaring insolvency has crossed your mind. If it has, it likewise makes sense that you have a great deal of personal bankruptcy inquiries that require responses. Lots of people in fact can not answer the concern "what is bankruptcy" in anything other than general terms.

If you are facing economic challenges in your individual life or in your business, opportunities are the principle of declaring insolvency has crossed your mind. If it has, it likewise makes sense that you have a great deal of personal bankruptcy inquiries that require responses. Lots of people in fact can not answer the concern "what is bankruptcy" in anything other than general terms.Many people do not understand that there are numerous kinds of personal bankruptcy, such as Chapter 7, Chapter 11 and Phase 13. Each has its benefits and challenges, so knowing which is the most effective choice for your present scenario as well as your future healing can make all the distinction in your life.

The Facts About Bankruptcy Law Firm Tulsa Ok Revealed

Chapter 7 is termed the liquidation insolvency phase. In a chapter 7 personal bankruptcy you can eliminate, clean out or discharge most types of financial obligation.

Numerous Chapter 7 filers do not have a lot in the way of possessions. Others have homes that do not have much equity or are in severe demand of repair work.

Financial institutions are not allowed to go after or preserve any kind of collection tasks or suits throughout the situation. A Phase 13 bankruptcy is extremely effective because it supplies a system for borrowers to prevent foreclosures and constable sales and quit foreclosures and utility shutoffs while capturing up on their secured debt.

The Ultimate Guide To Top Tulsa Bankruptcy Lawyers

A Chapter 13 case may be useful in that the debtor is enabled to get caught up on home loans or car loans without the hazard of foreclosure or repossession and is permitted to maintain both exempt and nonexempt residential or commercial property. The debtor's strategy is a document outlining to the insolvency court just how the borrower recommends to pay existing costs while repaying all the old debt balances.

It provides the borrower the chance to either offer the home or come to be caught up on home mortgage settlements that have actually fallen back. A person submitting a Chapter 13 can suggest a 60-month strategy to treat or come to be present on mortgage repayments. As an example, if you fell back on $60,000 worth of mortgage payments, you could recommend a strategy of $1,000 a month for 60 months to bring those home loan repayments existing.

It provides the borrower the chance to either offer the home or come to be caught up on home mortgage settlements that have actually fallen back. A person submitting a Chapter 13 can suggest a 60-month strategy to treat or come to be present on mortgage repayments. As an example, if you fell back on $60,000 worth of mortgage payments, you could recommend a strategy of $1,000 a month for 60 months to bring those home loan repayments existing.The Greatest Guide To Top-rated Bankruptcy Attorney Tulsa Ok

In some cases it is far better to stay clear of personal bankruptcy and resolve with creditors out of court. New Jersey also has an alternate to personal bankruptcy for companies called an Job for the Advantage of Creditors and our law office will review this choice if it fits as a potential approach for your company.

We have actually created a tool that assists you select what chapter your documents is probably to be submitted under. Click below to use ScuraSmart and discover a feasible solution for your financial obligation. Lots of people do not understand that there are numerous types of bankruptcy, such as Phase 7, Chapter 11 and Phase 13.

Here at Scura, Wigfield, Heyer, Stevens & Cammarota, LLP we manage all kinds of bankruptcy instances, so we have the ability to address your insolvency questions and assist you make the most effective choice for your case. Tulsa OK bankruptcy attorney Below is a short take a look at the financial debt relief choices bankruptcy lawyer Tulsa available:.

The Only Guide for Tulsa Ok Bankruptcy Attorney

You can just declare bankruptcy Prior to filing for Phase 7, at the very least one of these ought to be real: You have a great deal of financial obligation earnings and/or assets a financial institution can take. You shed your copyright after being in a crash while uninsured. You require your certificate back (bankruptcy attorney Tulsa). You have a whole lot of financial obligation near the homestead exemption quantity of in your home.

The homestead exemption quantity is the greater of (a) $125,000; or (b) the area median sale cost of a single-family home in the preceding schedule year. is the amount of cash you would certainly maintain after you marketed your home and settled the home mortgage and other liens. You can discover the.

Report this page